Long-term real estate investing has long been viewed as a profitable way to build wealth and diversify portfolios. Among the myriad options, the friction between commercial and residential housing plays an important role. Each asset has its own unique characteristics, benefits and considerations which investors must carefully weigh.

In this comprehensive insight, we will examine the nuances of commercial and residential financing, providing a rounded perspective by understanding factors such as each property, important considerations, risks and benefits of comparisons, market trends, tax implications and discussion of success stories For potential investors.

Understanding Commercial Property:

Commercial properties embody a huge variety of assets, inclusive of office spaces, retail centers, business warehouses, and hospitality institutions. The primary distinction lies in their usage for commercial enterprise sports in preference to residential functions.

Commercial real property, especially in growing markets like Noida, has witnessed tremendous attention, with developments along with Commercial Property in Noida turning into hotspots for investment.

The capacity for excessive condo yields, longer lease terms, and appreciation make commercial homes an appealing choice for traders in search of stable and long-time period returns.

Exploring Residential Property:

On the other side of the spectrum are residential houses, comprising single-family own family homes, residences, and condominiums. Residential real estate property is often considered as an extra solid and familiar terrain for traders due to its regular demand, pushed via individuals looking for places to live.

The dynamics of residential investments are prompted via factors such as population boom, employment opportunities, and lifestyle options.

In India, the real estate property market has witnessed a simultaneous increase in commercial and residential properties, presenting investors with numerous options to consider.

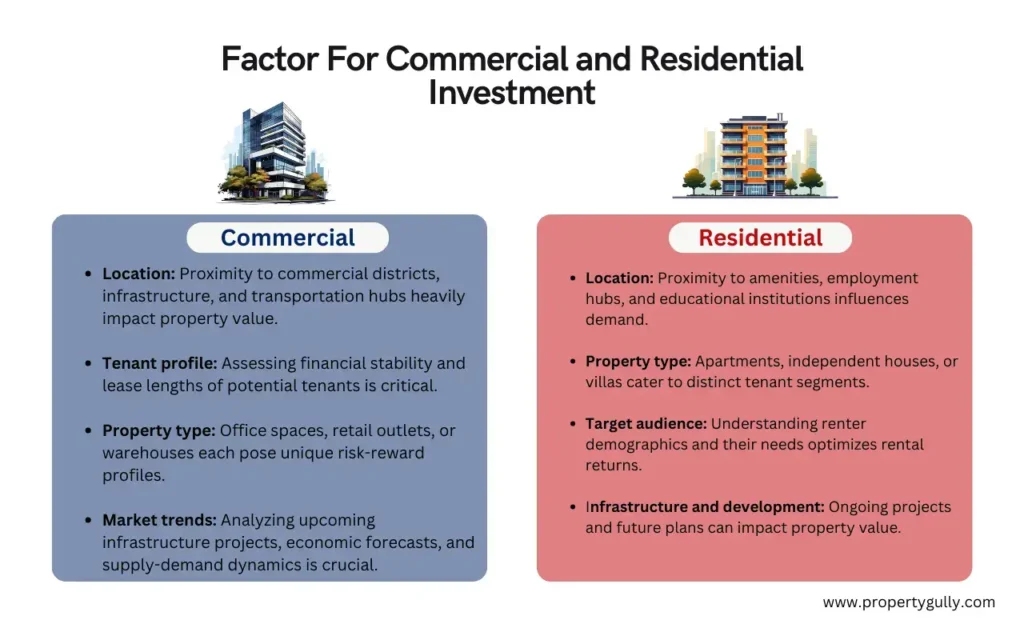

Factors to Consider in Commercial and Residential Investments:

Commercial Investments:

It is important to go into the details of a commercial investment and consider factors such as location, property size, tenant characteristics and the economic viability of the area.

Proximity to a transport hub, amenities and a good working environment play an important role in determining the success of a commercial property investment.

Understanding the specific needs of potential tenants and knowing the market is important to making informed decisions.

Residential Investments:

Residential investments have unique considerations, including attractive neighborhoods, infrastructure and overall quality of life.

Investors should analyze the likelihood of rental income, property appreciation and demographics that could affect demand.

The ability to adapt to changing lifestyle preferences such as the demand for smart homes or sustainable living can make residential investment more attractive

Risk and Return Comparison:

One of the most important aspects of any investment decision is assessing the associated risks and potential returns. Commercial properties generally offer higher rents, but can come with higher upfront costs and longer vacancies.

Although residential properties are considered more stable, perhaps lower yields can provide consistent rental income. The risk appetite of an investor, as well as their financial objectives, will play an important role in determining the best balance between commercial and residential investments

Market Trends and Demand:

Keeping a finger on the pulse of marketplace trends and demand is paramount in actual estate investing.

Indian real estate is anticipated to witness steady growth inside the coming years, driven through rising urbanization, demographic shifts, and monetary growth. Both industrial and residential segments are poised for superb performance, albeit with versions depending on specific places and property types.

Commercial real estate is expected to benefit from growing demand for office spaces, co-working hubs, and logistics facilities. Noida, Pune, and Bengaluru are predicted to guide this growth, driven by using robust IT/ITES presence and infrastructure development.

Residential demand is projected to rise throughout the country, with affordable housing and student housing witnessing significant growth. Tier-2 and Tier-three towns are expected to see a surge in call for due to growing affordability and populace migration.

Read Also: Exploring Different types of Real Estate Investment

Tax Implications and Regulations: Understanding the Rules

Navigating the complexities of taxation and regulations is crucial for informed investment decisions. Commercial and residential property investments have specific tax implications, including fees, property taxes and capital taxes. It is highly recommended that you consult with a financial advisor who is experienced in real estate taxes.

In addition, regulations governing property transactions and construction vary from state to state

Tips Before You Invest in Properties:

Before diving into the real estate market, prospective investors should heed some essential tips:

- Conduct thorough market research: Analyze local trends, demand, and vacancy rates.

- Consult financial advisors and real estate professionals: Seek expert guidance on investment strategies and risk management.

- Maintain a diversified portfolio: Consider investing in both commercial and residential properties to mitigate risk.

- Focus on long-term goals: Real estate investments offer long-term returns, so avoid short-term speculation.

- Be prepared for market fluctuations: Have a financial buffer to weather potential downturns.

Case Studies and Success Stories:

Examining real-world case studies and success stories provides investors with valuable insights. Be it booming commercial properties in Noida or rapidly growing residential investments in the suburbs, these stories offer lessons on strategy, risk management and market timing.

Learning from successes and failures in the real estate industry can help investors prepare their minds and make informed decisions.

Commercial properties in Noida:

A group of investors bought office space in Noida based IT hub and secured a long-term contract with the multinational. The property generated consistent and substantial rental income over a five-year period.

Residential Investment in Mumbai:

Someone bought a two bedroom house in a good location in Mumbai. If they rented it, they made a steady income, while the value of the property increased over time.

In conclusion, investing in commercial or residential property in India requires careful consideration of your risk tolerance, investment objectives and financial resources Understanding the unique characteristics of each sector, thorough analysis with expert advice, you can make informed decisions and navigate the exciting world of real estate investing Can Remember, there is no “one size fits all” answer. The best option depends on your personal circumstances and financial goals.

Looking for more information? Contact us for expert guidance on property investment and unlock your investment potential!