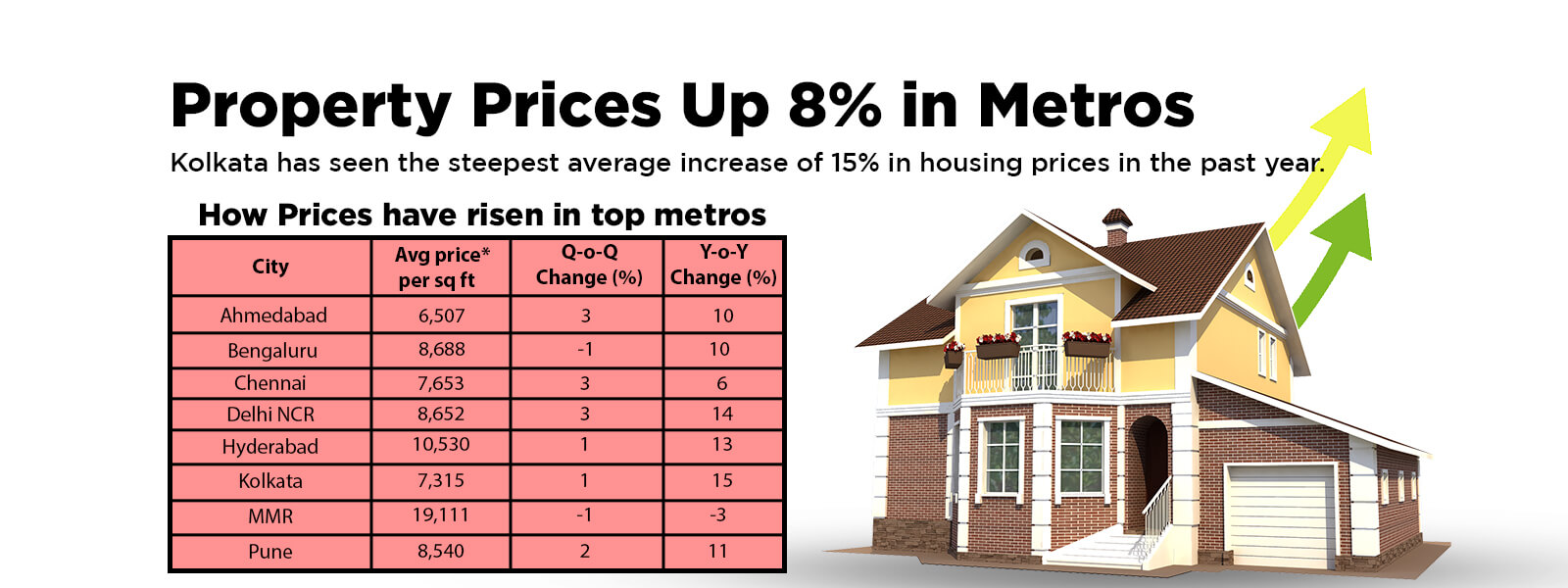

Kolkata has seen the steepest average increase of 15% in housing prices in the past year

Housing prices in the eight metros have shot up 8% in the past year “amid robust housing demand backed by continued positive homebuyer sentiment and stable interest rates”, according to a report by CREDAI and Colliers Liases Foras. Kolkata has seen the steepest increase, with property prices rising by an average 15% in the past year. “Housing prices in Kolkata have been on the rise over the past seven quarters. The recent surge in housing prices is owing to the rising demand boosted by positive government incentives such as extension of 2% reduction in stamp duty and 10% reduction in circle rates till September 2023,” the report stated. Delhi NCR was in second place, with housing prices in the northern region having risen 14% in the past 12 months. Hyderabad stood third, witnessing a rise of 13% in housing prices, claimed the report. At the micro market level, Golf Course Road (46%) and Dwarka Expressway (40%) in Delhi NCR have seen the sharpest rise in housing prices. “Housing prices on the Golf Course Road continue to surpass the prices in Delhi in the second quarter of 2022-23, attributed to its improving connectivity and proximity to commercial office hubs in Gurugram, which have sparked a surge in demand for residential properties,” the report added. Vimal Nadar, Senior Director and Head of Research, Colliers India, said some areas were seeing more interest. “While most cities saw a double-digit price increase during April-June 2023, Delhi NCR has been consistently seeing an uptick in housing prices for the past 12 quarters. Notably, the newly developed Dwarka Expressway and the upcoming 6-lane highway in Delhi NCR are expected to further drive demand,” he said. Housing prices in Bengaluru surged 10%, with prices in the periphery and outer west micro markets witnessing the highest rise of 42%, led by the upcoming high-end projects. Housing prices of 3-BHK units surged the highest at 12%, followed by 2-BHK units, owing to the rising demand for mid- segment residential properties. A pause in repo rate change by the RBI during February has boosted homebuyers’ sentiment, said Peush Jain, Managing Director, Occupier Services, Colliers India. “With repo rate stabilizing at 6.5% since February, homebuyer sentiments remain positive due to greater visibility in EMIS. While developers continue to grapple with the challenges of higher cost of construction, housing demand is unaverred. It is likely to accelerate in the next few quarters due to the upcoming festive season and preference for home ownership,” he said. The report also noted that unsold inventory in Delhi NCR had declined 7% in the past 12 months, making it the only city to witness such a drop. “Unsold inventory in Delhi NCR has been witnessing a drop for the past two quarters, signaling a positive consumer buying sentiment,” the report added. However, unsold inventory levels rose in some places due to a flurry of project launches. The inventory rose 26% in the northwest suburb of Ahmedabad and 24% in the southwest micro market of Hyderabad. “Despite the increase in unsold inventory, housing prices in both the cities have consistently shown a rise over the past few quarters,” the report said. Pankaj Kapoor, Managing Director, Liases Foras, said the housing market had maintained its prudence and discipline primarily due to a high number of new launches over the past year. “The momentum is continuous. Increasing supply has kept the price rise moderate and productive, drawing both the end-user and long-term investors. Sales are likely to continue to grow since affordability and prices maintain parity,” said Kapoor.

Reference : The Economic Times Wealth